GOOD day amigos: Algae-tech ripping it in FFF (Fuels, Feeds and Fertilisers)

The Paxtier report 16/02/22: Featuring climate market updates, Seawith investments and valuing algae-tech markets

“Every moment is a fresh beginning.” —T.S. Eliot

Hello and welcome to Paxtier’s weekly roundup for Wednesday, February 16, 2022! This week we investigate how to model markets for novel seaweed products, showcase the Bitcoin miners drying seaweed, and bring you a hole in one worth its weight in gold.

Climate markets

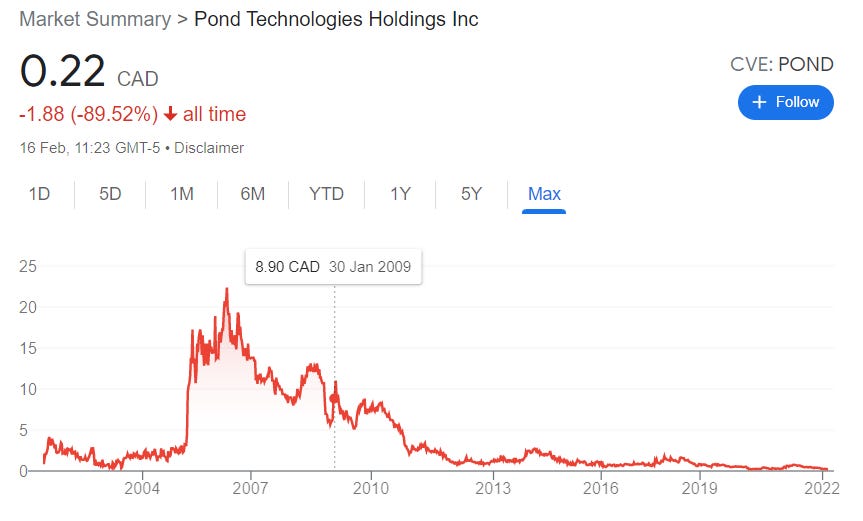

Let’s be real for a minute, climate-tech ain’t going anywhere. This week was a climate-tech stonker with investments ramping up left, right and centre while the Wild West faced the worst drought in 1200 years. Bay Bridge Ventures launched an institutional ESG and Sustainability-focused fund, and more than 20 organisations like ClimateWorks, Microsoft, and EY, released plans for the Carbon Call, a plan to develop an interoperable carbon emissions accounting system, making it easier for companies to benchmark, compare, and share their footprint data. That followed updates from the Zuckerberg’s who pledged $44 million to climate-tech, and the Biden administration who called for a $5 billion network of electric vehicle chargers. In the algae space, we saw major investment in Seawith’s alternative seaweed protein technology, and big moves from the U.S. Department of Energy’s Bioenergy Technologies. Early stage enterprises continued to dominate news headlines as algae-tech 1.0 firms such as Pond Technologies launched new marketing campaigns to broadcast their latest developments and re-energise their dwindling stock prices.

Paxtier’s Top 4

Algae and sustainable aviation fuels

Can sustainable aviation fuels compete with traditional fuels? That’s the theme of this market update which considers whether Congress will implement new policy innovations to decarbonise aviation, an industry creating 2% of all greenhouse gases. The microalgae for biofuels argument is revisited which highlights the need to invest more and improve policy in the space in order to facilitate economies of scale. Read more here.

Seawith complete Series A

Seawith – a cultivated steak pioneer from South Korea – has announced the completion of a ₩6.5 billion ($5.43 million) Series A investment, as the startup looks to lead the cultivated meat movement in the country. Seawith champions algae as a scaffolding to grow meat, which the company claims will allow it to produce thick-cut cultivated beef at $3 per kilogram. They are now focusing on investment in production facilities and commercialization. Here’s what CEO Lee Hee-jae had to say:

“Seawith has developed a key technology that is important for commercialization of cultured meat. Many foreign protein alternative food development companies are also interested in our technology; we are preparing for cooperative research and development with them now.” Read more here.

Hydrogen from diatoms as a Source of Clean and Renewable Energy

Recently, Rai et al. documented the potential scope and methodologies for producing hydrogen from living diatoms. Diatoms are single-celled algae with cell walls composed of transparent, opaline silica (glass). This paper outlines the role diatoms can have in energy-generating hydrogen fuel cells/photobioreactors and investigates how these setups can also be used to harvest the diatoms for products like biofuels and fucoxanthin. Read more here.

Exploring mechanisms to pay for ecosystem services provided by mussels, oysters and seaweeds

The rapidly developing sector called seaweed ecosystem services is the focus of this paper by van den Burg et al. In this investigation, the research team explore the ways these ecosystem services can be financed. The team conducted a Delphi method to consult experts across the world and come up with six mechanisms which are considered feasible; tax-payer funded payments, tradeable credits, encouraging subsidies, social licenses to produce, production cost-sharing schemes and increased utility for consumers. The most promising looking mechanism involves increasing utility for consumers, which means growing consumer awareness of the importance of the ecosystem service provided (e.g through eco-labeling). In this way, consumers end up paying the costs of the service through price premiums on final products. Read more here.

Sustainable Bitcoin miner uses waste heat to dry seaweed

At the Honefoss Bitcoin mining operation in Norway, the hot air generated by Bitcoin mining rigs is recycled and used to dry out chopped logs. Kjetil Hove Pettersen, CEO of Kryptovault, told Cointelegraph that Norway is an “ideal location for mining” and that alongside the log-drying operation, seaweed drying operations will kick off in the first half of 2022. Read more here.

Tweets of the week

More algae-tech in the news

Zanzibar Eyes Oil and Seaweed in $2 Billion Growth Plan: The five-year blueprint proposes developing an oil and gas industry alongside efforts to boost its “blue” economy, Hussein Mwinyi, president of Tanzania’s semi-autonomous archipelago, said in an interview.

Experts Discuss the Future of Ocean-Based Carbon Removal Research: The ethics of geoengineering are presented alongside a National Academies of Sciences, Engineering, and Medicine report which was released late last year calling for a $125 million research program to explore six different nascent ocean-based CO2 removal strategies.

Snow algae get a lookover : Snow algae are commonly found on snow surfaces worldwide. Their blooming changes the surface color to red from white due to their red cells, accelerating melting during summer. This team developed a new numerical simulation for snow algal blooming which has the potential to be used for global prediction of future red snow phenomena, which are likely to synchronize with global climate change.

DOE announces $19M for carbon utilization funding opportunity: In Washington, D.C., the U.S. Department of Energy’s Bioenergy Technologies Office announced up to $19 million in federal funding for the advancement of technologies that utilize waste carbon to reduce greenhouse gas emissions and produce reliable feedstocks for biotechnologies, with this particular funding opportunity aiming to increase the capability of algal systems to capture carbon dioxide and put it to productive use.

Cooperl, biogas, fertiliser, & algae from pigs: Cooperl is a circular agricultural pig farming cooperative based in Brittany, France. Founded in 1966 by 24 pig producers, it now has a turnover of €2 billion a year and 7, 200 employees. It doesn’t stop at pigs though… As far as possible, outputs from every process are reprocessed and used as inputs for another. This means that pigs are only one aspect of their business: the cooperative also makes high-value products from agricultural waste, turning nitrogen and phosphorus recovered from manure into mineral fertiliser and farming waste into biogas. In the latest company news, Cooperl has decided to redirect some of their 156, 000 tonnes of raw biogas digestate per year into alternative animal feed. As a partner on the €6.5 million ALG-AD project, it is helping conduct R&D into algae-based feed. The company is now culturing microalgae on nutrients recovered from the manure biogas plant as microalgae are among the few organisms that can metabolise these byproducts.

New technology lets us spot seaweed from space: University of South Florida optical oceanographer Chuanmin Hu and his colleagues have worked out ways of spotting aggregations of small floating objects, such as shrimp eggs, algae, and herring spawn, from space. And not only can they find these buoyant masses—they can tell you which is which. Different objects, being made of different materials, reflect characteristic wavelengths of light—patterns that scientists can read using multispectral instruments mounted on satellites.Hu and his team, along with scientists around the world, are building a knowledge base of what different objects and materials look like from space. That way, when they come across an unfamiliar floating object on a satellite image, they can look to see whether the wavelengths it reflects match up with anything that’s been analyzed before.

The licensing system for aquaculture in Scotland sucks: An Aquaculture Regulatory Process review, headed by Professor Russel Griggs OBE, concludes that the stakeholders working with the current licensing system for aquaculture in Scotland see it as “not fit for purpose”. The review proposes that different regulatory solutions are developed for finfish, shellfish and seaweed production. A single consenting document would be required for all forms of aquaculture and producers would pay a single licensing payment based on the tonnage output of the site concerned. Portions of the funds raised through the licensing charge would be earmarked for the benefit of the local community and for supporting scientific research.

How imaging is used in fish farming: Farms are looking for ways to improve productivity, but there are significant concerns over the environmental impact caused by waste feed and the transmission of diseases to native fish populations. Imaging can help with both of these challenges, making farms more productive and reducing their environmental impact. This piece looks at various uses of imaging technology from teams such as Aquabyte, JT Electric, Pharmaq, Fishtec, and Maritech.

Pull To Refresh announces that it has enlisted two new team members, macroalgae expert Louis Druehl, Ph.D., founder of Canadian Kelp Resources, and Kelp Seed Production Manager Amy McConnell to scale its ocean based seaweed climate solution. Read more here.

Algae drives up ship emissions by 25%: Researchers have said keeping ships clean is vital in the fight against climate change as a thin layer of algae covering 50% of a ship's hull potentially increases its greenhouse gas emissions by 20-25%. Coventry-based Sonihull may have the answer. The company has developed what is effectively a small speaker that fixes on to the hull of boats and vibrates. The tiny vibrations, too small to interfere with sonar equipment on boats, or indeed with marine life, create tiny bubbles around the hull. When those tiny bubbles implode they destroy the single-celled organisms that would cling to the surface of the boat.

Arizona State University teams up with City of Mesa on pilot project to remove greenhouse gases with algae: This pilot program is set up at a wastewater plant in Mesa. Under the program, wastewater is pumped into ponds filled with microalgae, and the CO2 and methane in the wastewater can grow the algae, which can then be used to create valuable resources.

An account of the risks of seaweed aquaculture: When Typhoon Odette battered central and northern Palawan in mid-December last year, coastal farmers lost all of the seaweeds they were growing, leaving them with very little to start with as they tried to propagate a new batch of these marine plants. This article highlights just one of the many challenges seaweed farmers have to contend with.

In depth with Peter Green

How to model the market for your seaweed product

I was recently asked how I might go about developing a model that predicts the global market and market trend for a seaweed product. Naturally, there are varying degrees of analysis that can be done here, but I’d like to show you my approach to this question. Below you’ll find an outline of a suitable methodology you could use to gather and present this kind of information.

The product

I chose to model the market for Asparagopsis taxiformis methane-reducing supplements thanks to there being a high likelihood of commercial success for this product, positive recent developments from the likes of Volta Greentech, and a good technology readiness level.

Market defined and component parts

When it comes to modelling, the first step involves defining the market. In this case, we are investigating a completely new one: the methane reduction market for ruminant livestock farmers. If we break this down further, the main components of this market are farmers for cattle, elk, reindeer, bison, horses, deer, sheep, goats.

Our trusty tool, 80/20 analysis, can be used here to highlight the main subsectors (cattle, buffaloes, sheep and goat farmers), which can be subdivided further into 8 farming categories: Cattle meat, Cattle dairy, Sheep meat, Sheep wool, Goat milk, Goat meat, Buffalo milk, Buffalo meat.

How to estimate price points and volumes

Generally, we could guess price points and volumes based on similar products but, given the novelty of methane-reducing supplements and the level of detail we are expecting, better estimations of price and volumes will result from considering, quantifying and inserting driving factors of demand into the model. These can be seen below and represent my assumptions about what significantly affects this market.

Drivers of demand: Costs, supply chain, price, investment

In order to predict total market and trends, we should collect/estimate data for the following market driving factors:

Costs of production (Capital Expenditures and Operating Expenditures)

CAPEX: processing facility. OPEX: processing and distribution costs.

Factors affecting raw Asparagopsis seaweed costs: Will supply come from local markets? How much will transportation cost? Will supplement producers grow their own seaweed? Middle men? Will there be enough global supply of this notoriously challenging seaweed?

Potential to scale commercially, economies of scale and sector investment. For example, is there access to patient capital? Is burn rate low enough to survive product-market fit?

Price the farmers might pay. Hold conversations with farmers to evaluate pain points in this area

Drivers of demand: TRL

Technology readiness level must be assessed and the following factors need to be accounted for in the model:

Can bioprocessing be made more efficient?

Will life cycle of A. taxiformis be closed, and can ocean based grow-out be made more efficient?

Is there potential to develop biorefinery processing to enable efficient co-production of multiple applications at low cost?

Can we get clear data concerning the potential negative impacts on rumen digestibility and the health impacts of bromoform?

What trends are there in seaweed farming automation?

Is there enough talent to help scale this industry to meet volumes required?

Will competitors readily share information to develop the market faster?

How prepared is the industry if the sector encounters diseases, or other natural disasters affect the world?

Drivers of demand: Regulation, product-market fit

In addition, we should collect/estimate data for the following market driving factors:

Changes in regulations e.g government subsidies, emission credit schemes, and streamlined licensing processes to enable rapid expansion in farming capacity.

Penetration and geography: where are the buyers? Due to high priority of methane reduction for the planet, expect high penetration.

Signs of product market fit: Have producers found customers in early adopter markets and have there been letters of intent from early majority firms?

Competition from other methane reducing additives, and the effect of other climate technologies on demand for methane reducing additives.

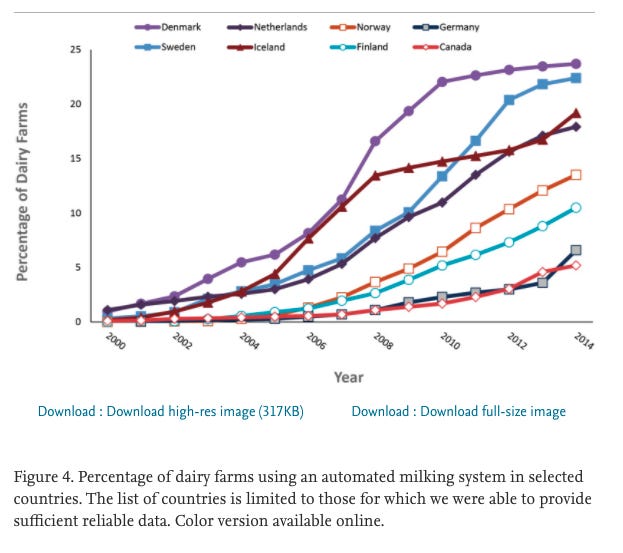

Historical new feed adoption information as a way to forecast how new tech is adopted by farmers in this space. If this is unavailable, look for alternatives: vitamins or antibiotics.

Drivers of demand: Macroeconomics

Sustainability trend should be monitored. The importance of quality, traceability and locally-sourced, sustainable produce is becoming more relevant (Effect can be estimated through calls with economists and literature reviews or through conversation with potential buyers.)

Alternative protein trend should be considered, plus data forecasting the demand for meats and cheeses over the next 10 years.

General economic growth (8% CAGR) will influence the overall trend too.

Public opposition to farming or environmental impacts of farming seaweed must be considered.

Sensitivity Analysis

Once estimates have been collected in these areas, an overall prediction of the price, volume, market and future trend can be made. These baseline numbers can be iterated regularly in short review cycles with experts and suppliers.

Following the establishment of a baseline, a sensitivity analysis would be carried out to create a range of outputs for these driving factors to give:

A conservative ambition prediction

A moderate ambition prediction

A high ambition prediction

Short term viability

If asked to consider short/medium term viability, it’s reasonable to assume that success depends on the company attracting early adopters and maintaining a low burn-rate during pre-revenue.

This assumption is based on the high-technology adoption curve seen in Crossing the Chasm, and evidence from cattle farms which suggests technology adoption in this sector takes the same shape over long time periods:

As a result, I would analyse viability in the short/medium term by looking largely at demand drivers indicating product-market fit (letters of intent), TRL, and cost structure.

How would you analyse its viability long-term (5-10 years)?

According to the technology adoption curve, long-term viability will depend more on analysing/predicting saturation in niche markets (eg. Australian cattle-meat farmers), and predicting when hard-tech organisations will start to create revenue. This can be done by:

Gathering data which highlights a roadmap to offering whole products to mainstream markets e.g co-cultivation business models (Symbrosia), or scientific data highlighting potential for biorefinery processing of Asparagopsis.

Monitoring for signs of product-market fit. Have producers found customers in early adopter markets and how many letters of intent have been made by early majority firms?

Gather data around potential to saturate a niche market e.g potential to produce Asparagopsis at volume to meet demand of all Australian cattle-meat farmers.

Gather additional data around potential to overcome key long-term barriers, both technological and economic: (sustainability, can farming be scaled locally, can costs be reduced for bioprocessing and farming, can strong data be collected around performance, will there be supply chain resolution, the possibility of competition from other methane reducing additives, how might other climate technologies affect demand for this methane reducing additive.)

How to gather data

Generally, estimates of these driving factors can be made on the basis of extensive research in scientific journals, industry publications, expert interviews, start-up interviews and other relevant sources. At times, comparisons can be made with other feed additives in the space to formulate pricing and volume predictions.

Concerning further data availability, other assumptions (e.g macroeconomic trends data) can be collected from publicly available information such as:

Company SEC filings, annual reports, company websites, and investor presentations for competitive scenario and shape of the industry

Regional government and statistical databases for macro analysis, authentic news articles and other related releases for market evaluation, internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecast.)

A. Hall showcasing a mind-blowing pullback

Cleanup on aisle 16

Jobs

Postdoctoral Research Fellowship in Microbiology, algae and related fields. Portugal

PhD position: ‘Selective breeding of sterile sporophytes of the brown seaweed Saccharina latissima” Netherlands

Thanks again for joining us this week! Looking forward to seeing you soon.

Best,

Peter

Paxtier